Here’s Why Planet Fitness (NYSE:PLNT) Is Catching Investors’ Eyes

It is common for many investors, especially inexperienced ones, to buy shares in companies with a good story even if these companies are making losses. Sometimes these stories can cloud the minds of investors, leading them to invest based on their feelings rather than the company’s sound fundamentals. Loss-making companies are always running against time to achieve financial performance, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward does not agree, you may be interested in companies with high returns, such as Planet Fitness (NYSE:PLNT). While profitability is not the only metric to consider when investing, it is important to pay attention to businesses that can consistently generate it.

Check out our latest review for Planet Fitness

Planet Fitness’ Enhanced Benefits

Over the past three years, Planet Fitness has grown its earnings per share (EPS) at an impressive rate from relatively low levels, producing a three-year growth rate that does not reflect expected performance over time. coming. So, it makes sense to focus on recent growth rates, instead. Planet Fitness’ EPS rose from US$1.48 to US$1.86; the result is bound to keep the shareholders happy. That’s a staggering 26% profit.

High growth is a great indicator that growth is sustainable, and combined with high earnings before interest and tax (EBIT), is a good way for a company to maintain a competitive advantage in the market. Planet Fitness maintained stable EBIT levels last year, all while growing revenue by 6.9% to US$1.0b. It’s progress.

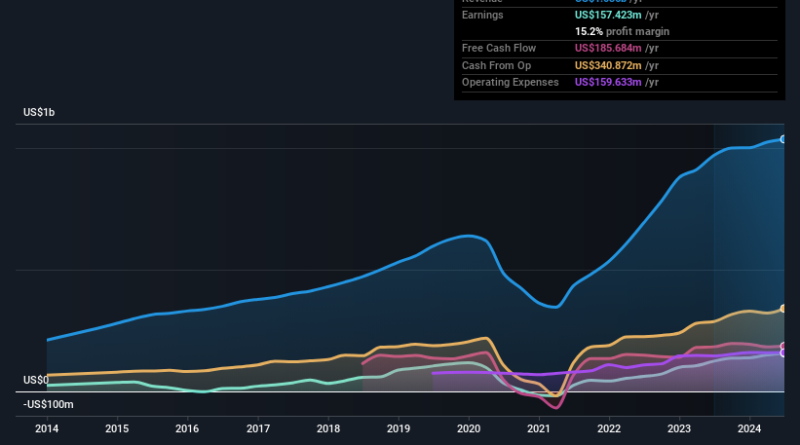

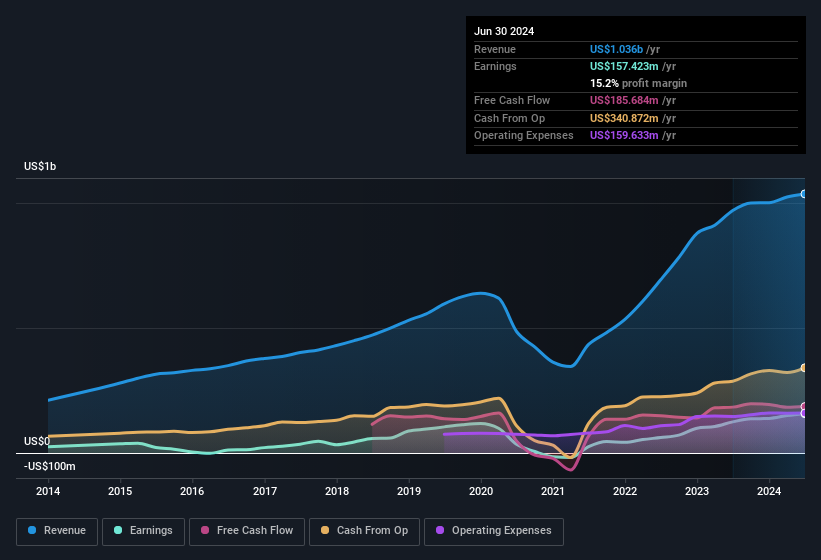

You can view the company’s revenue and earnings growth trend in the chart below. Click on the chart to see the exact numbers.

Fortunately, we have access to Planet Fitness’ reviewer ratings. the future profit. You can make your own predictions without looking, or you can look at what the experts are predicting.

Does Planet Fitness Insiders Connect With All Members?

Since Planet Fitness has a market capitalization of US$6.7b, we wouldn’t expect insiders to own a large portion of the shares. But we are comforted by the fact that they are investors in the company. To be precise, they have shares worth $22m. This major investment should help drive long-term value in the business. Although the owners are responsible for only 0.3%, this is still a big risk to encourage the business to maintain a strategy that will provide value to the shareholders.

Is Planet Fitness Worth A Place On Your Watch List?

If you believe that share price follows earnings you should be keeping up with Planet Fitness’ strong EPS growth. Additionally, the high level of insider ownership is impressive and suggests that management values EPS growth and has faith in the continued strength of Planet Fitness. The rapid growth and insider confidence should be enough to warrant further research, so it would seem like a good asset to pursue. Don’t forget that there can still be risks. For example, we saw 2 warning signs for Planet Fitness what you should be aware of.

There is always an opportunity to do well buying that stock they are not growing incomes and do not having insiders buy shares. But for those who think about these important metrics, we encourage you to check these companies do have those features. You can find a curated list of companies that have shown growth supported by great insiders.

Please note that the internal transactions mentioned in this article refer to the transactions that can be reported in the relevant area.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of new Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

#Heres #Planet #Fitness #NYSEPLNT #Catching #Investors #Eyes